Cosmetologists from around Washington state are headed for Olympia Monday. They're concerned a proposed law could harm some independent hair stylists and others in the beauty industry.

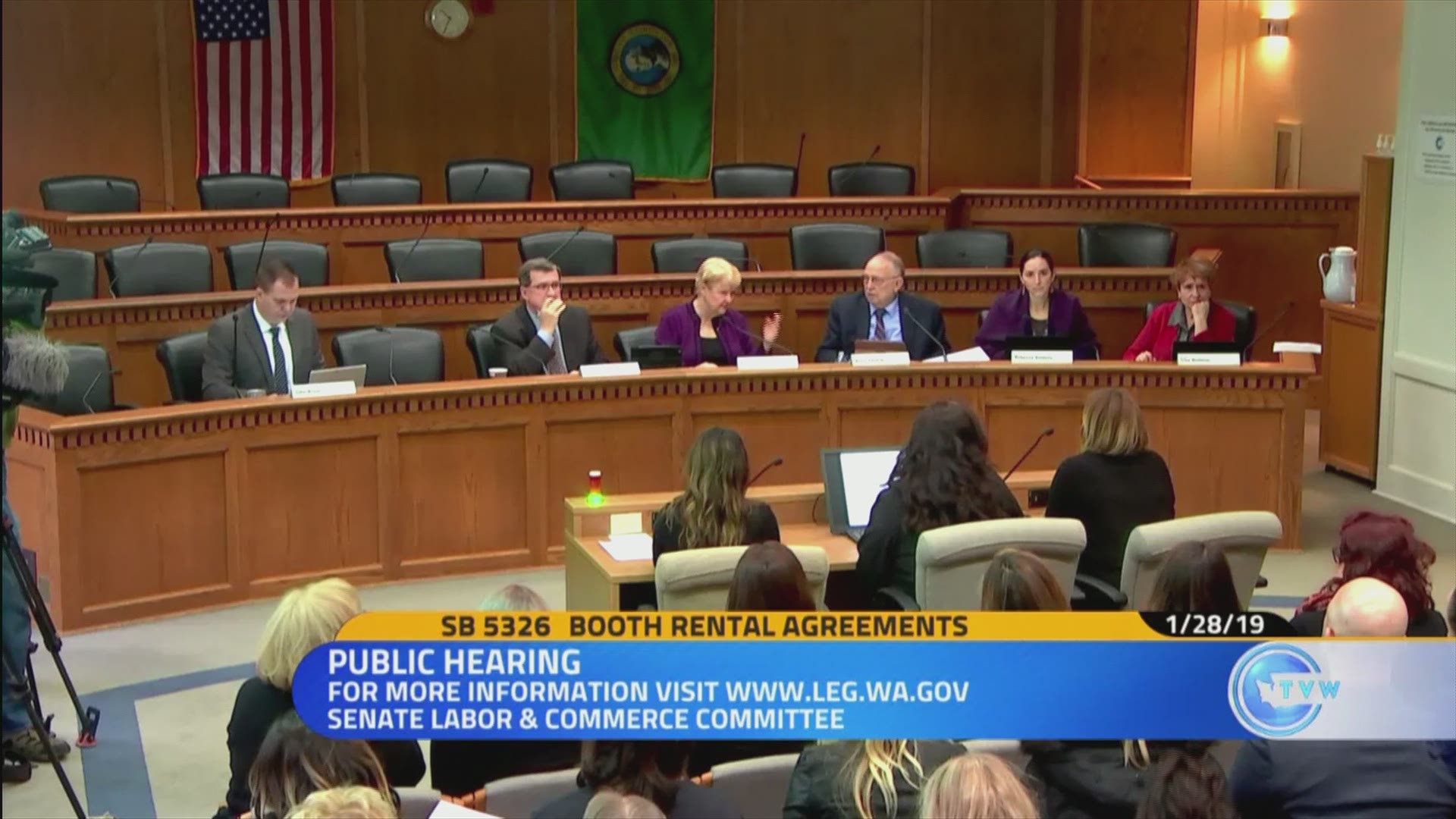

Senate Bill 5326 sought to make hair stylists who rent booths or chairs pay more taxes.

A summary of the bill distributed by Senate Democrats claimed "booth renters" were currently exempt from Business & Occupation (B&O) taxes. However, stylists who rent booths are indeed paying them.

The Washington State Department of Revenue confirmed with KING 5 that stylists who rent booths are not exempt from B&O taxes.

The Jamie O’Neill Salon in Seattle’s Queen Anne neighborhood would normally be closed and dark on a Sunday afternoon, but stylists and salon owners used the day to sort through proposed legislation that could impact the tax structure for stylists.

“We are barely covering our overhead, and I think it's a misconception that just because you get your haircut, we're doing great,” said salon owner Jamie O'Neill. “It's very hard to survive in Washington state with the taxes that we pay."

O'Neill said it has been tough sorting out exactly what the legislation would mean, but she doesn't think it will impact the stylists who work out of her location because they pay all the taxes outlined in the proposed legislation. However, she's concerned it could hurt other small businesses.

“The hair industry is probably the leading female-dominated industry, and it's our chance to become sort of financially independent, and I feel like this bill is taking that away from us,” said O'Neill.

Senator Karen Keiser (D-Kent) proposed the bill and said they're not trying to ruin anyone's livelihood.

“Any stylist that's playing by the rules and paying their taxes and maintaining their licenses will have no impact," Keiser explained.

Keiser said the legislation is part of a look into the industry and not a final decision.

“There are underground economies in several industries, and we understand that, and we're working with that,” she said. “Underground economies generally involve cash transactions and non-reporting.”

Stylists worry it would force some people back into jobs at corporate salons where they take home only a small percentage of what is charged for their work.

Mandi Smiley has a special needs son and said working at a corporate salon didn’t work for her family.

“I've worked in chain salons before and they do serve a purpose, it's great for some people,” said Smiley. “When my son was sick I wasn't able to stay home with him because they call it shift abandonment.”

The hearing is set for Monday at 10 a.m., and Keiser said she hopes both sides can share information and clear up some misinformation about the issue.