You likely have insurance for your car and maybe a prized possession, but will your house be covered when the “Big One” hits?

Western Washington is earthquake country, and if you don’t already have earthquake insurance, it may be something to consider as you’re making a disaster plan for your family.

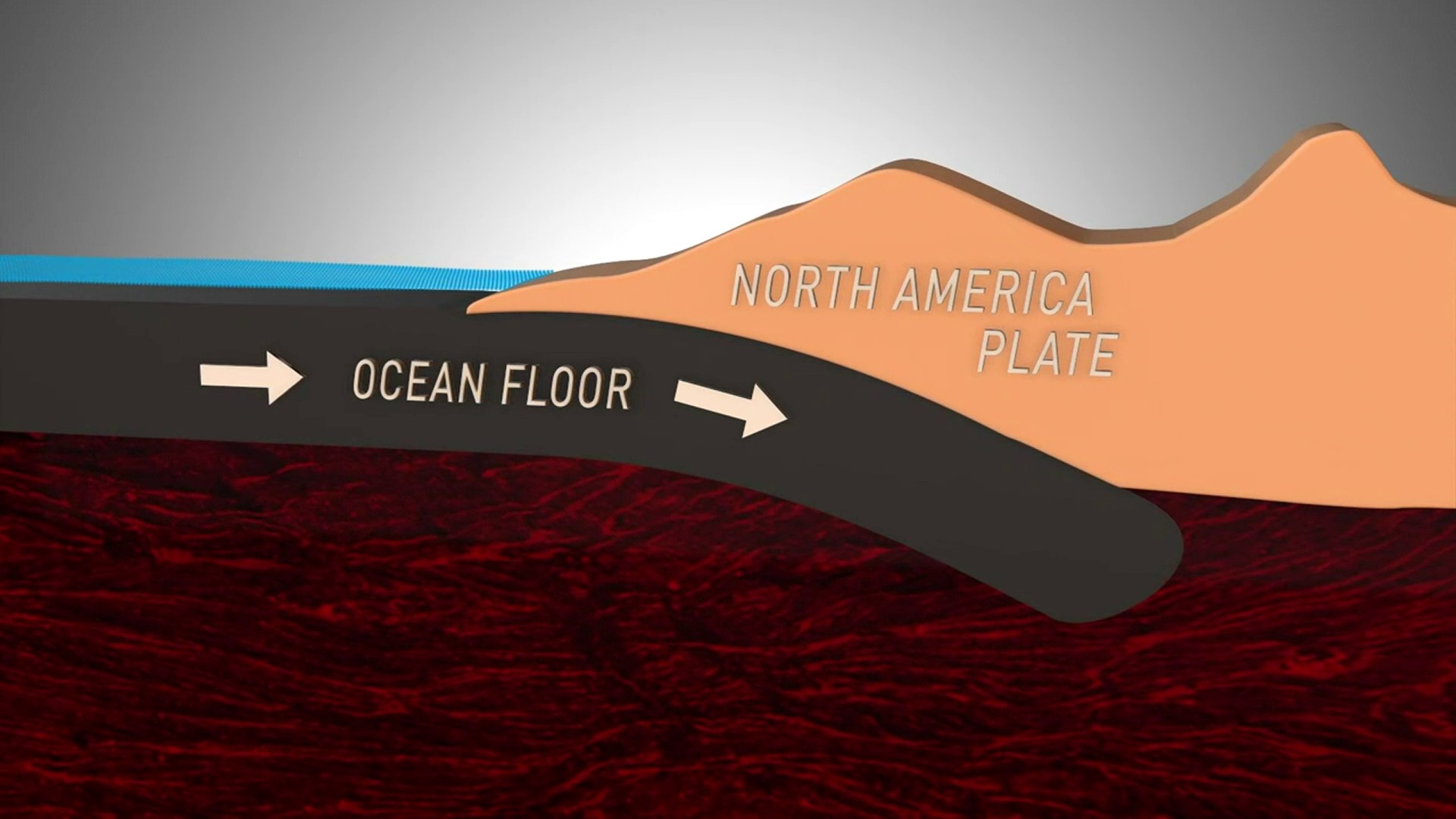

The Puget Sound region is impacted by the Seattle and South Whidbey faults, along with the Cascadia Subduction Zone, which runs off the coast from northern California to British Columbia and could produce a magnitude 9 earthquake.

Earthquake insurance is an added endorsement to your existing homeowner’s or renter’s policy or can be a separate policy you buy, according to the Washington Office of the Insurance Commissioner.

The NW Insurance Council, a nonprofit funded by member insurance companies, estimated last year that premiums for a $500,000 brick house could range from $3 to $15 per $1,000 of a home’s value. That works out to an annual premium between $1,500 and $7,500.

Insurance is usually sold with a 10 to 25 percent deductible of the structure’s policy limit and will only pay out for damage that exceeds the deductible. For example, if a policy with a 15 percent deductible covers that same $500,000 house, a homeowner would be responsible for paying $75,000 before insurance kicks in.

Earthquake insurance covers home repairs, debris removal, extra living expenses while your home is repaired, and insures personal property against earthquake damage. Keep in mind it may not cover other events triggered from an earthquake, such as tsunamis.

When deciding if you should purchase earthquake insurance, know that brick homes, wood frame homes with a crawl space, or a multi-story home are more likely to be damaged in an earthquake. Older homes can also carry higher premiums.

The insurance commissioner’s office also urges consumers to think about how they would manage costs from a destructive earthquake. Ask yourself questions such as could you repair your home without insurance, how would you pay to live elsewhere while your home is being rebuilt, or how much of a mortgage do you owe even if the home is destroyed?

The insurance commissioner's office reported in February that 13.8 percent of homeowners in Western Washington have earthquake insurance.

In addition to thinking about earthquake insurance, make sure your family has a disaster plan in place in case an earthquake strikes. Emergency management officials recommend to prepare to be on your own for two weeks after a disaster. Disaster kits should include a gallon of water per person per day, food, first aid kit, warm clothes and sturdy shoes, medical prescriptions, and a NOAA weather radio. Find more information on how to make a kit and comprehensive disaster plan for your family here.

KING 5's Glenn Farley contributed.