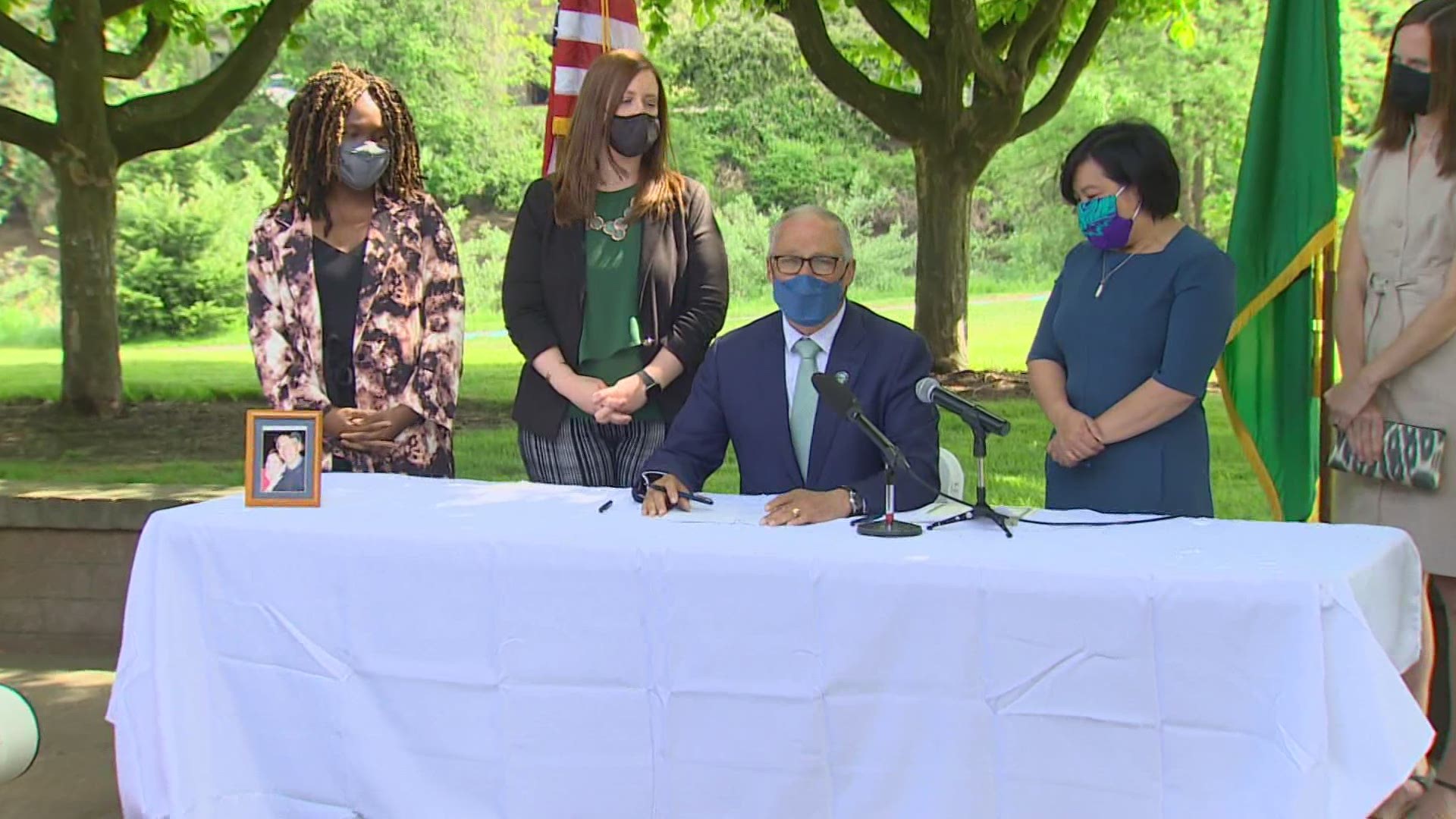

Editor's note: The video above aired May 4, 2021, when Washington's capital gains tax was signed into law.

SEATTLE - Voters will weigh in on Washington state's new capital gains tax on high-profit assets with Advisory Vote 37.

The Washington state Legislature imposed the tax, without voter approval, earlier this year. Gov. Jay Inslee signed the tax into law in May 2021.

It imposes a 7% tax on the sale of stocks, bonds and other high-end assets in excess of $250,000 for both individuals and couples.

The tax took effect July 25. However, taxes will not be imposed until Jan. 1, 2022. It's expected to bring in $415 million in 2023, the first year the state would see money from the tax.

The tax includes exemptions for all real estate, retirement accounts, livestock, agricultural land, fishing privileges, family-owned small businesses, and more. It is estimated to affect about 7,000 of the state's wealthiest taxpayers, generating $5.7 billion in its first ten years.

Revenues collected from the tax would be deposited in the Education Legacy Trust and Common School Construction Account. The money will be used to fund investments in K-12 education, childcare and early learning.

The decision put before voters won't change how the capital gains tax is collected. An advisory vote helps gauge public opinion.

"Advisory votes are non-binding and the results will not change the law," according to the Washington Secretary of State's office.

"We are finally, finally asking the wealthiest among us to pay their fair share," said Rep. Noel Frame, D-Seattle, at the May bill signing ceremony at the Tukwila Community Center.

Senate Minority Leader, Sen. John Braun, R-Lewis County, said the tax is unnecessary and unconstitutional. He said he considers it an income tax and said it should be overturned by the state’s Supreme Court or voters through an initiative.

Former Washington state Attorney General Rob McKenna filed one of the lawsuits challenging the tax, on behalf of a coalition of farmers, business owners, investors and the Washington State Farm Bureau.

McKenna's lawsuit claims the law is unconstitutional by labeling the capital gains tax as an excise tax – which the group says are typically taxes on privileges like owning a business or transactions on gas, cigarettes or alcohol – instead of an income tax.

“If this is an excise tax, it’s an illegal one,” McKenna said in a statement.

However, Inslee has said he considers it an excise tax and believes it would survive legal challenges.

Washington voters can select "maintain" or "repeal" to voice how they feel about the capital gains tax.

Watch king5.com for special coverage of Washington's 2021 general election shortly after the first results drop on Tuesday, Nov. 2. Then tune into KONG 6/16 at 9 and 10 p.m. and KING 5 News at 11 for team coverage across western Washington.