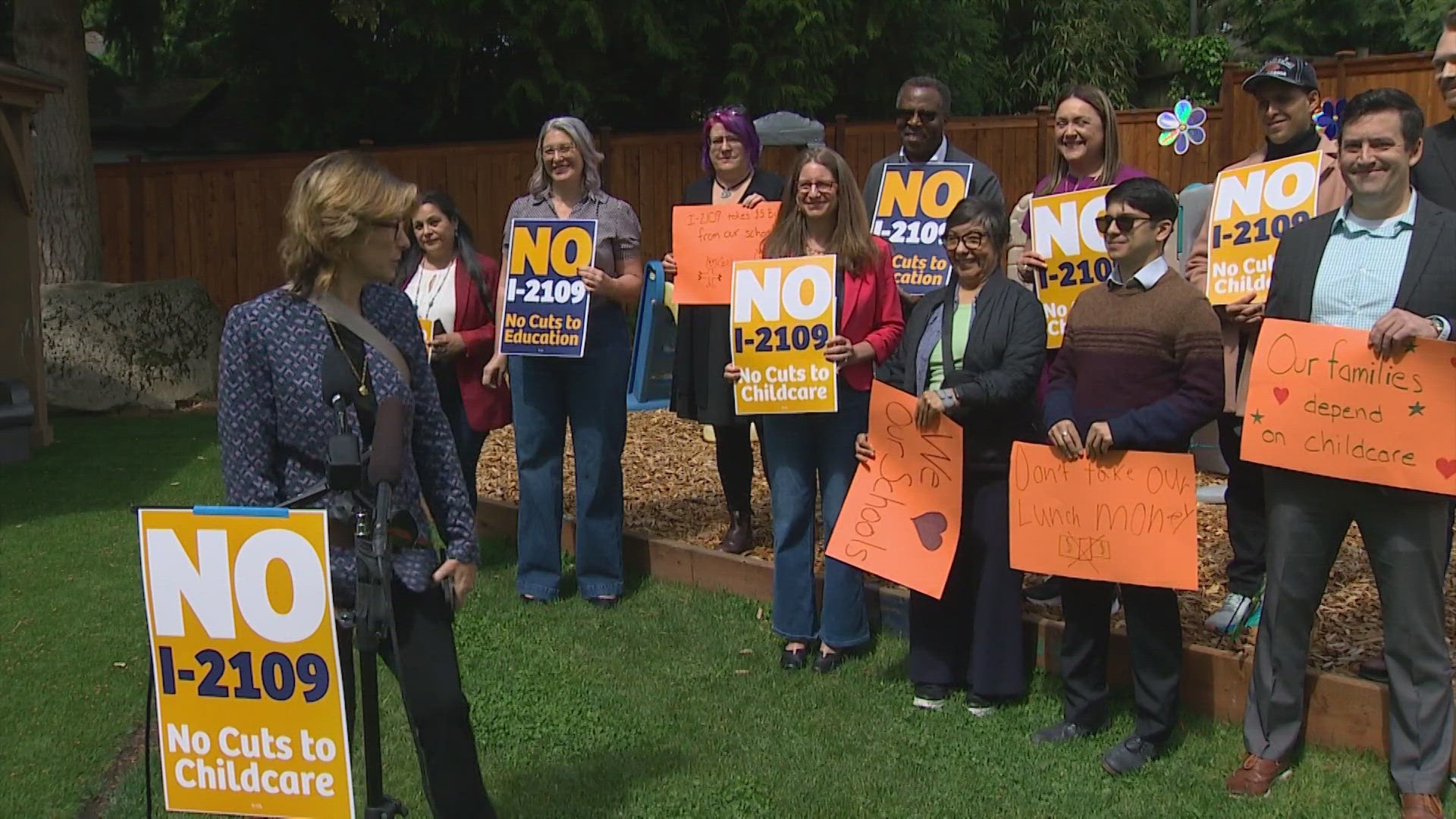

BURIEN, Wash. — Education advocates, lawmakers, childcare centers and parents launched a campaign Wednesday urging voters to select "no" on Initiative 2109, which would repeal the capital gains tax currently used to help fund early childhood education services.

The group "Let's Go Washington" gained enough signatures to put the repeal measure on the November ballot.

State lawmakers passed a capital gains tax in 2021 that taxes 7% off the sale or exchange of stocks, bonds and other assets above $250,000, with some exemptions. The money goes to measures like childcare subsidies for qualifying families, bonuses for childcare centers offering hard-to-cover hours, and school construction. The tax went to the state Supreme Court and was ruled constitutional.

Diana Llanes runs a daycare and preschool serving families she says would be impacted were the tax repealed.

"If the funding ends it will affect families, and it will affect businesses, my small business, and I won't be able to provide work for my staff," Llanes said.

Many parents have cited the difficulty finding childcare already, with the fear it will become even less accessible if the tax is repealed.

"I'm not going to leave my kids if I don't think they're safe and well cared for, no job is worth that, and so many working people, especially working women, are forced to choose between what might be a better-paying job or better opportunity and the well-being of their children -- and they're going to choose their children," parent and restaurant owner Damiana Merryweather said.

Brian Heywood sponsored several initiatives through Let's Go Washington, including I-2109.

"I'm not trying to force this one way or another, obviously I have an opinion," Heywood said. "I think it's bad for the state and bad for the economy but really what we're doing here is giving the voters a choice."

Heywood argued the capital gains tax is "volatile" and not the right source of revenue to base early childhood education on. He believes the capital gains tax is a "gateway" of sorts to a future income tax.

"I think it's a dishonest move from the very beginning," Heywood said. "I'm not trying to force this one way or another, obviously I have an opinion. I think it's bad for the state and bad for the economy but really what we're doing here is giving the voters a choice."

Opponents of I-2109 believe repealing the tax could have a "ripple effect."

"Losing students, losing funding, then the staff," Llanes said. "If I [can't] provide for the families, [they can't work and] they'll get behind on their own bills and stuff."

Voters will have the chance to weigh in on a potential repeal on Nov. 5.