With its most successful subscriber growth period ever — from October to the end of the year — Netflix could be emboldened to raise prices sooner rather than later, suggest some Wall Street analysts.

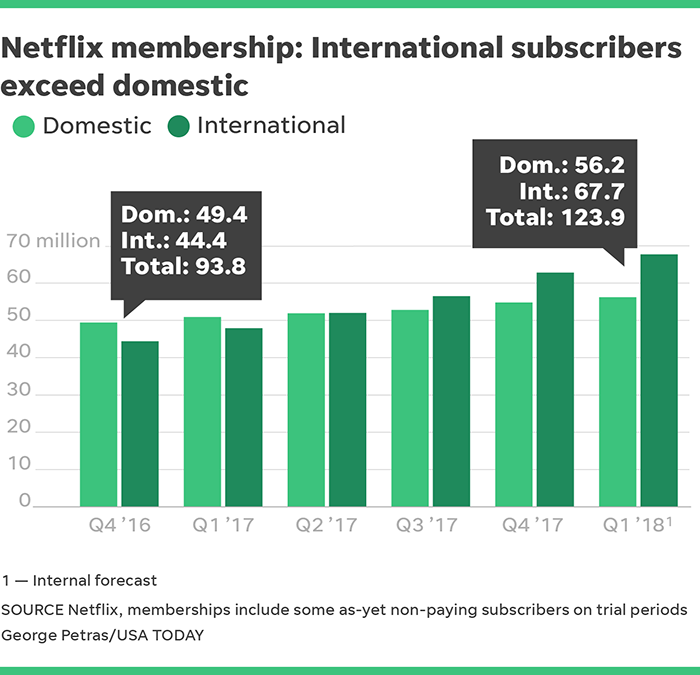

During the most recent three-month period, Netflix added more than 8.3 million new members. That's 2 million more than the Los Gatos, Calif.-based company had expected.

"Extraordinary," is how Netflix CEO Reed Hastings described the quarter.

Wall Street loved the success, too, with Netflix (NFLX) shares hitting new historical highs Monday before and after the company announced its financials, and again Tuesday before closing at $250.29, up 10%.

Netflix's exceptional growth during a period in which it increased monthly subscription prices, for the first time in two years, suggests that the Internet TV service could increase prices again, without significant membership losses. In 2016, as a price hike eventually kicked in for current members — it was announced in 2014 for new members, but grandfathered in for existing members — the service saw some growth slowdown.

But not this time around. The quarterly gains boosted Netflix to nearly 117.6 million total global members.

"You can make a case actually the product is still relatively underpriced compared to some of the competition," said Tuna Amobi, director and senior equity analyst at CFRA Research, who maintains a Buy rating on Netflix shares. "With all this content they have got, which is a premium product that is offered at less than a premium price, if you think about HBO and CBS and some of these other guys, that is why I think the market might be swallowing that price increase a little bit better."

Netflix versus the alternatives

HBO Now, available for more than two years now, is a standalone subscription service, costing $14.99 monthly. Launched three years ago, CBS All Access is a subscription service with on-demand episodes and live TV, which costs $5.99 monthly for viewing with limited commercials or $9.99 for no commercials.

Netflix increased by $1 to $10.99 the cost of its most popular plan — two screens watching simultaneously — and by $2 to $13.99 its premium plan, which lets you run Netflix on four screens and get 4K video. The $7.99 monthly price of the basic one-screen, standard definition-video plan remained the same.

There is obviously still room for additional price increases, with another one most likely late next year or in early 2020, says Anthony DiClemente, senior managing director for Internet research at investment banking advisory firm Evercore ISI, which has a target price for Netflix shares of $220. "As long as the content still resonates with customers and viewership hours continue to grow, customers will be willing to pay more for Netflix," he said.

Compared to the cost and hours watched on traditional pay-TV services, "Netflix still represents a 40% discount," he said.

So cord cutters might have to get used to regular price increases — as long as the company keeps rolling out shows and movies people can't watch anywhere else.

In general, Netflix should be expected to increase prices 4% to 5% every year, said Michael Nathanson, founding partner at research firm MoffettNathanson, in an email interview.

Risks for Netflix, he says, include growing competition and the potential for costly original programming to not match “the early success of some of its hit shows.”

Still, Netflix's Hastings seemed to temper concerns of another price hike Monday.

"Consumers are tolerant as long as something's improving," Hastings said in a publicly broadcast interview. "But we're always cautious on it and we have no plans to like try to repeat that in any way in the near term."

While some analysts had suggested Netflix's U.S. grow was due to hit a wall, Hastings noted that five years ago the company estimated its U.S. market at 60 million to 90 million subscribers. So the streaming provider has, he said, "a ways to go just to cross into the bottom of our expectation range."