SEATTLE — Tax season is upon us, and believe it or not, how much we pay in taxes is within our control.

“We’ve created a tax structure where if you do things the way that Congress wants you to do them, you get rewarded by paying less taxes,” said David Donhoff, founder and senior advisor of Leverage Planners. “The name of the game is figuring out and learn how to do the things that the government wants to encourage you to do, because ultimately if you do everything you can properly, it’s possible to dramatically reduce how much you pay in taxes.”

To do this, you need to know the three types of tax dollars:

- Regular income tax dollars – When you earn money, you pay tax on that.

- Capital gains tax dollars – These are taxes taken on gains on interest rates or investment gains.

- Tax-free dollars – These dollars grow untaxed and can be spent untaxed.

Donhoff says you can combine these in ways that work to your advantage while playing within the rules and contributing back to society.

“The one absolute guaranteed way to pay the most possible taxes is to ignore them and just let it unfold as it unfolds,” Donhoff said. "It's kind of like sailing down a river without a sail -- it's going to take you wherever it takes you."

Most people have a 401k or IRA to save for retirement and can contribute to those without paying income taxes on that money currently. The taxes are not avoidable forever, though. With a Roth IRA or Roth 401K conversions, you pay taxes as you go through your working years, but ultimately at a lower rate today than you would in the future as a retiree.

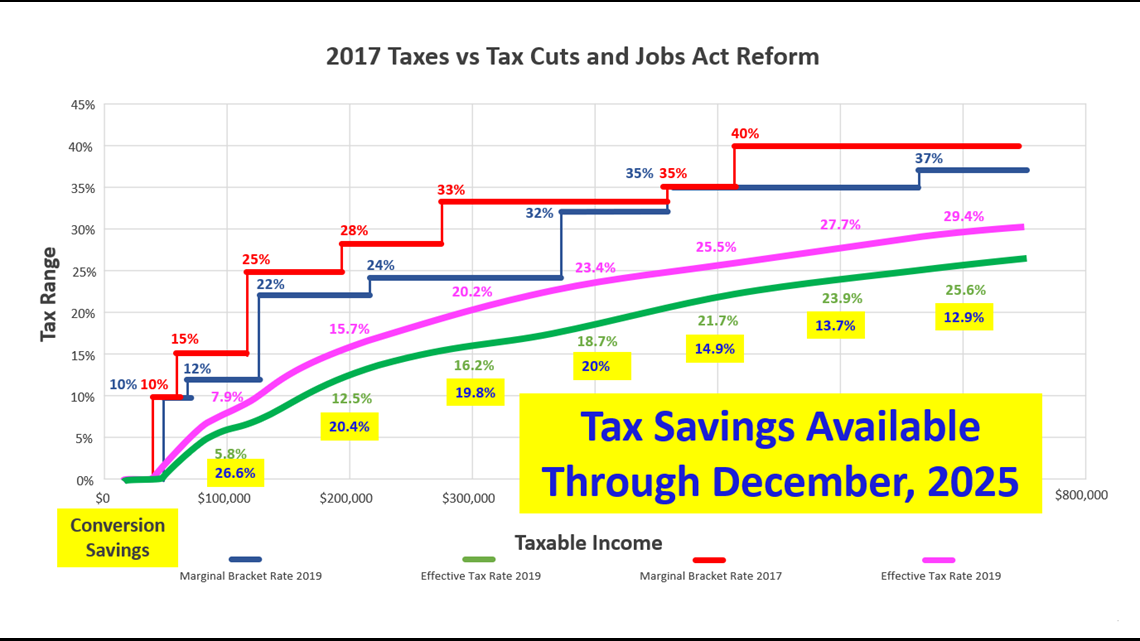

Additionally, the Tax Cuts and Jobs Act of 2017 has temporarily reduced tax rates for individuals until no later than December 2025. This makes it possible to pay the IRS taxes on retirement money at a lower rate than you likely would in the future. For instance, if you have a household income of about $100,000, you will pay 26.6% less if you pay taxes on your pre-tax retirement before December 2025 -- lowering your overall tax liability over your lifetime.

This will likely bring a substantial amount of tax savings in the long run to have a more enjoyable retirement.

“The name of the game is not to just have the lowest tax bill this year, but it’s to pay the least amount of taxes over the entirety of your life by following the rules and contributing back the way that Congress wants you to contribute,” Donhoff said.

To learn more tax and money-saving tips, visit the Leverage Planners website.

SPECIAL OFFER: Leverage Planners is also offering a portion of their Lifestyle Protection Plan FREE to New Day NW viewers! This financial analysis can help you save money now and plan for the future. Call 425-223-4520 to learn more.

Sponsored by Leverage Planners. Segment Producer Joseph Suttner. Watch New Day Northwest 11 AM weekdays on KING 5 and streaming live on KING5.com. Contact New Day.