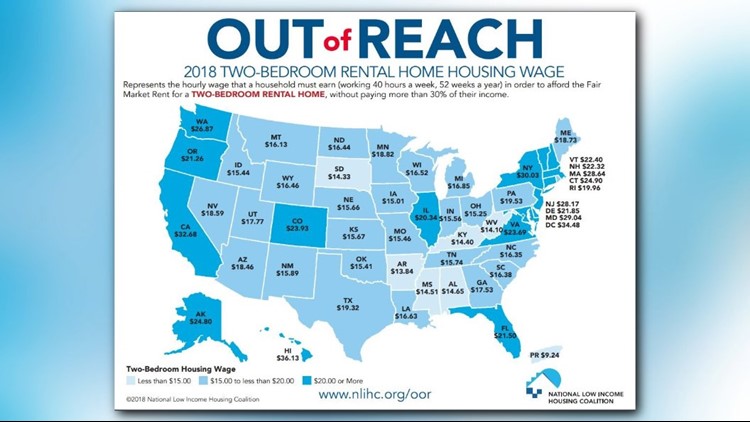

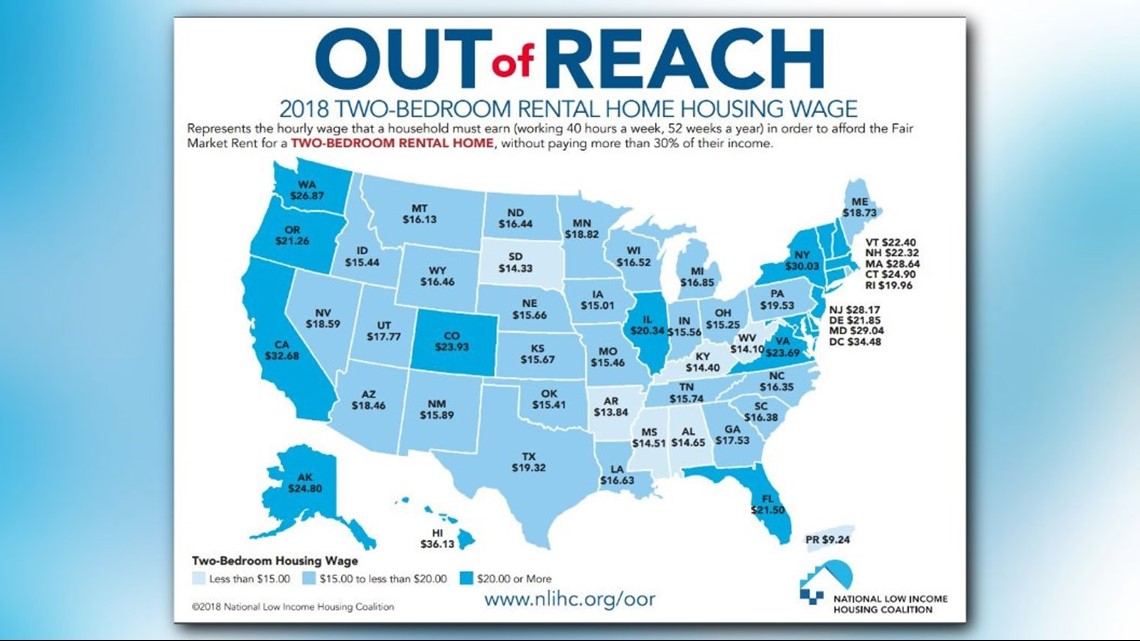

There is nowhere in the country where a person working one full-time minimum wage job can afford to rent a modest two-bedroom home, according to an annual report from the National Low Income Housing Coalition.

The numbers are even bleaker in Washington, which is ranked the 8th most 'out of reach' state for housing affordability.

The report says a minimum wage worker could afford to pay $598 per month in Washington, where the fair market rent for a 1-bedroom apartment is $1,121 per month.

The fair market rental on a 2-bedroom place comes in at $1,397 per month. That means a renter needs to make $26.87 per hour to afford a 2-bedroom unit in Washington.

An employee earning minimum wage would have to work 93 hours per week to afford the same place.

Rising rents are also hitting workers in Oregon. The report shows a renter would have to make $36,161 a year to comfortably afford a typical one-bedroom rental. But the average renter in Oregon earns $36,096.

The Oregonian/OregonLive reports the study uses fair-market rents, which are determined by the U.S. Department of Housing and Urban Development to set local values for housing vouchers. It considers housing to be affordable when it consumes less than 30 percent of a household’s income.

The coalition says its 2018 Out of Reach findings demonstrate "how far out of reach modestly priced housing is for the growing low-wage work force."

It can be tough to afford housing even in the least-costly of areas, the study found. While Arkansas was deemed the cheapest state for housing, a person working a 40-hour week there would still need to earn $13.84 an hour to afford a two-bedroom home. But the minimum wage in Arkansas is just $8.50.

At the other end of the price range, the report found Hawaii had the most expensive housing and would require a person to make $36.13 an hour, or $75,158 annually, to afford a decent two-bedroom apartment.

The coalition said nationally a worker would need to earn on average $22.10 to afford a two-bedroom home and $17.90 for a one-bedroom apartment.

That means a full-time worker earning the federal minimum wage of $7.25 would need to work 99 hours per week to afford a one bedroom apartment at the national average fair market rent.

The report also found that there are only 22 counties in the U.S. where a full-time minimum wage worker can afford a one-bedroom rental. They noted that each of those counties were in states with a minimum wage higher than the federal requirement.

States ranked by how much you'd need to make to afford a two-bedroom apartment (most expensive to least expensive):

1. Hawaii $36.13

2. District of Columbia $34.48

3. California $32.68

4. New York $30.03

5. Maryland $29.04

6. Massachusetts $28.64

7. New Jersey $28.17

8. Washington $26.87

9. Connecticut $24.90

10. Alaska $24.80

11. Colorado $23.93

12. Virginia $23.69

13. Vermont $22.40

14. New Hampshire $22.32

15. Delaware $21.85

16. Florida $21.50

17. Oregon $21.26

18. Illinois $20.34

19. Rhode Island $19.96

20. Pennsylvania $19.53

21. Texas $19.32

22. Minnesota $18.82

23. Maine $18.73

24. Nevada $18.59

25. Arizona $18.46

26. Utah $17.77

27. Georgia $17.53

28. Michigan $16.85

29. Louisiana $16.63

30. Wisconsin $16.52

31. Wyoming $16.46

32. North Dakota $16.44

33. South Carolina $16.38

34. North Carolina $16.35

35. Montana $16.13

36. New Mexico $15.89

37. Tennessee $15.74

38. Kansas $15.67

39. Nebraska $15.66

40. Indiana $15.56

41. Missouri $15.46

42. Idaho $15.44

43. Oklahoma $15.41

44. Ohio $15.25

45. Iowa $15.01

46. Alabama $14.65

47. Mississippi $14.51

48. Kentucky $14.40

49. South Dakota $14.33

50. West Virginia $14.10

51. Arkansas $13.84

52. Puerto Rico $9.24