PORTLAND, Ore. — Before taking his wife to the emergency room, Daryl Bunn called his insurance company. He wanted to find out which hospital was in-network, covered by the family’s insurance.

Molina Healthcare directed Bunn to PeaceHealth Southwest Medical Center in Vancouver.

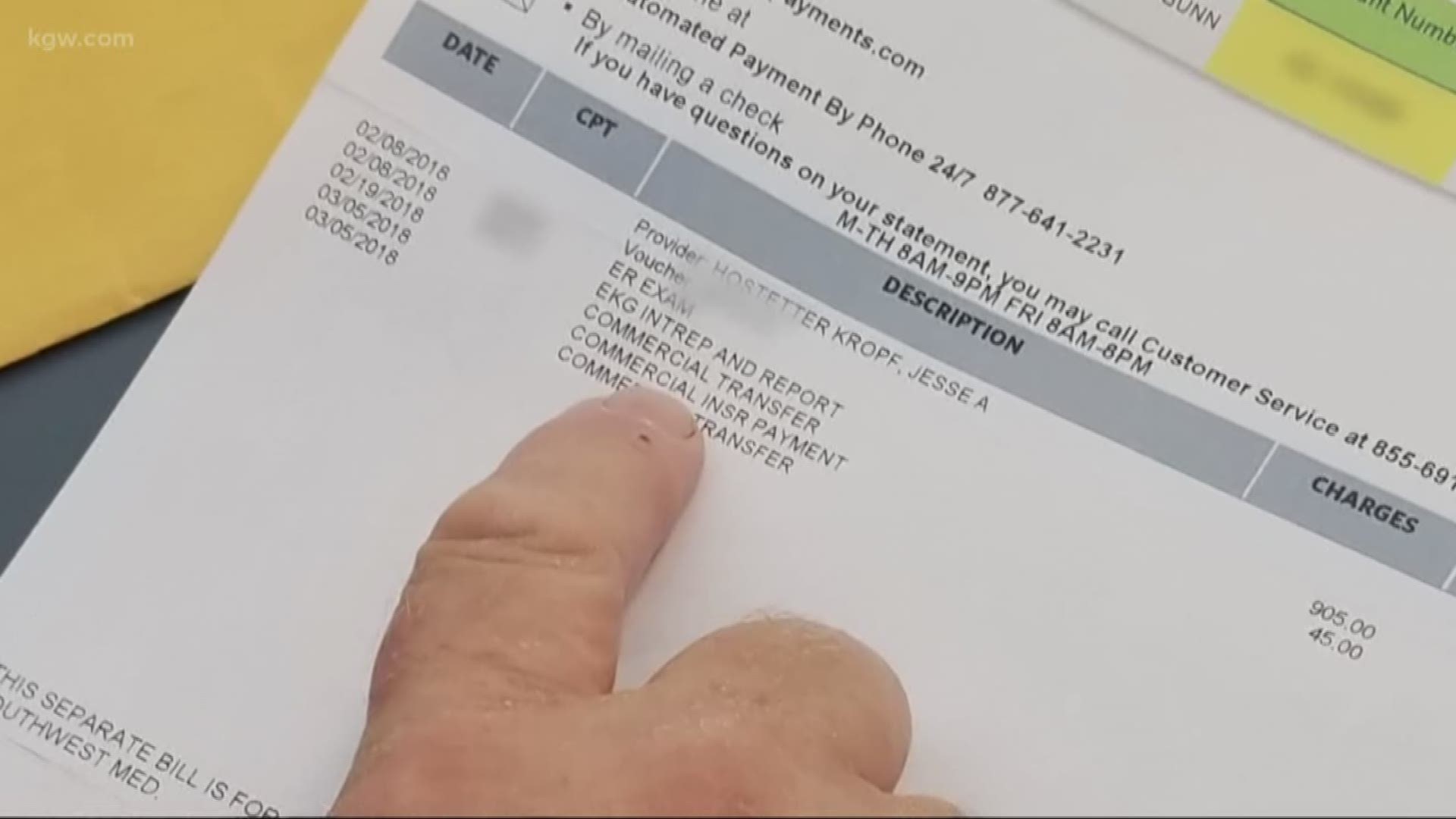

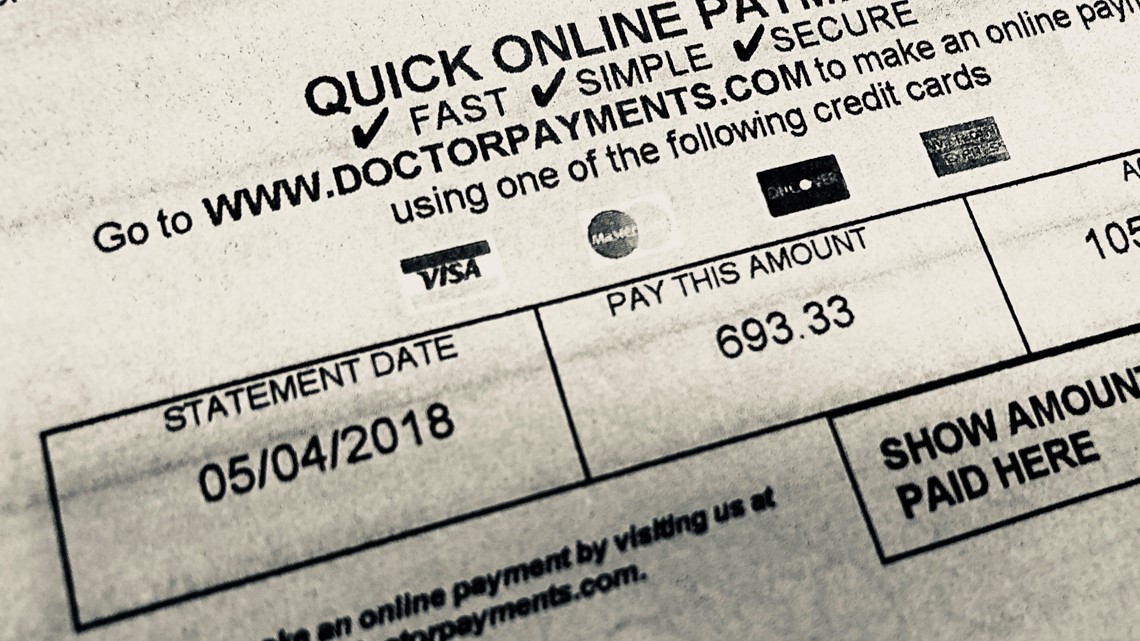

Despite his research, Bunn was blindsided by a $693 bill for an out-of-network doctor that treated his wife in the emergency room at PeaceHealth Southwest Medical Center, an in-network hospital.

“Why wasn’t I warned about this before I went to the hospital?” asked Bunn, who lives in Yacolt. “I had no idea. They did not say anything until the bill arrived 30 or 40 days later.”

Across Washington, consumers are being stung by surprise medical bills. Patients who have insurance can wind up with unexpected out-of-network bills, often resulting in hefty charges with little recourse.

“It happens way too often,” explained Washington State Insurance Commissioner Mike Kreidler.

Earlier this year, Kreidler pushed a bill in the Washington State Legislature that would have prevented people with insurance from receiving a surprise medical bill when they went to an in-network medical facility but were treated by an out-of-network provider. The bill died in the Senate.

Kreidler plans to re-introduce similar legislation next session in January.

“You’ve got the providers, hospitals and doctors on one side and you’ve got the insurance companies on the other side,” explained Kreidler. “You guys go fight it out, but get the consumer out of it.”

In 2017, 21 states had existing laws on the books that provided some consumer protection from surprise billing, according to a report by the Commonwealth Fund.

Since then, new legislation has been proposed and adopted in several states.

In March 2018, a new Oregon law went into effect protecting patients from receiving big surprise out-of-network bills when they are treated at the hospital or emergency room.

“In my opinion, people are losing money -- they’re getting ripped off,” said Bunn, who is still struggling with his wife’s hefty out-of-network bill.

“We don’t have a lot of money,” explained Bunn. “It’s very, very tight budgets.”

Molina Healthcare declined to comment or provide an explanation why the insurance company wouldn’t cover the out-of-network bill.

“We are committed to paying providers accurately and appropriately according to the terms of the member’s coverage. We cannot speak for a provider or explain a provider’s decision to balance bill a patient,” wrote Molina Healthcare in a statement.

Meanwhile, the out-of-network provider who treated Bunn’s wife in the emergency room is still pushing to get paid.

Emergency Medicine Associates initially demanded $693. When Bunn protested, the medical group offered a 30-percent discount.

After Bunn explained he wouldn’t pay, Emergency Medicine Associates sent the Washington couple to a collections agency.

Since then, the collections agency has withdrawn its demand for money but Emergency Medicine Associates sent a bill for $485.

“What’s going on with this company?” asked Bunn, explaining he’s still not sure how much he owes or how he is going to pay.

KGW called and emailed Emergency Medicine Associates seeking comment and clarification on Bunn’s bill.

Emergency Medicine Associates did not make anyone available to answer questions.

Instead, Dr. Dan Gorecki of Emergency Medicine Associates sent KGW an email offering contact information for a trade organization, the American College of Emergency Physicians. Dr. Gorecki did not provide any other details.

Bunn said he’s reached out to his state representative in hopes of changing Washington law. He’d like greater protection for patients who are blindsided by surprise medical bills.

“It’s just not right,” explained Bunn.

PeaceHealth provided the following written statement in response to KGW’s request for comment:

“As a mission-driven, not-for-profit health system, PeaceHealth is committed to providing care for all, regardless of ability to pay. When a patient is treated at PeaceHealth they sign a Consent for Treatment form that states they will receive a bill that includes goods and professional services provided by the hospital. It also states that patients may be billed separately for additional contracted services, such as anesthesia, laboratory, and specialty services, depending on the scope of the care received.

PeaceHealth Southwest Medical Center has agreements with numerous insurance companies, which places it within their networks. Those same insurance companies may or may not have agreements with some of the contracted services patients may need and access during their hospital visit.

PeaceHealth recognizes the complexities of the bills patients receive following a hospital visit and also acknowledges the common frustrations experienced by patients when receiving bills they did not expect. PeaceHealth continues to advocate alongside other regional healthcare providers to ensure that that insured patients seeking care in qualified emergency situations are covered at in-network rates for any and all services received. While this does not eliminate a patient receiving more than one bill, it does eliminate any concerns of out-of-network charges.”