SEATTLE — The Washington State Department of Revenue launched a new tax credit Feb. 1 for Washington state residents. The Working Families Tax Credit (WFTC) is available for individuals and families who meet certain eligibility and requirements.

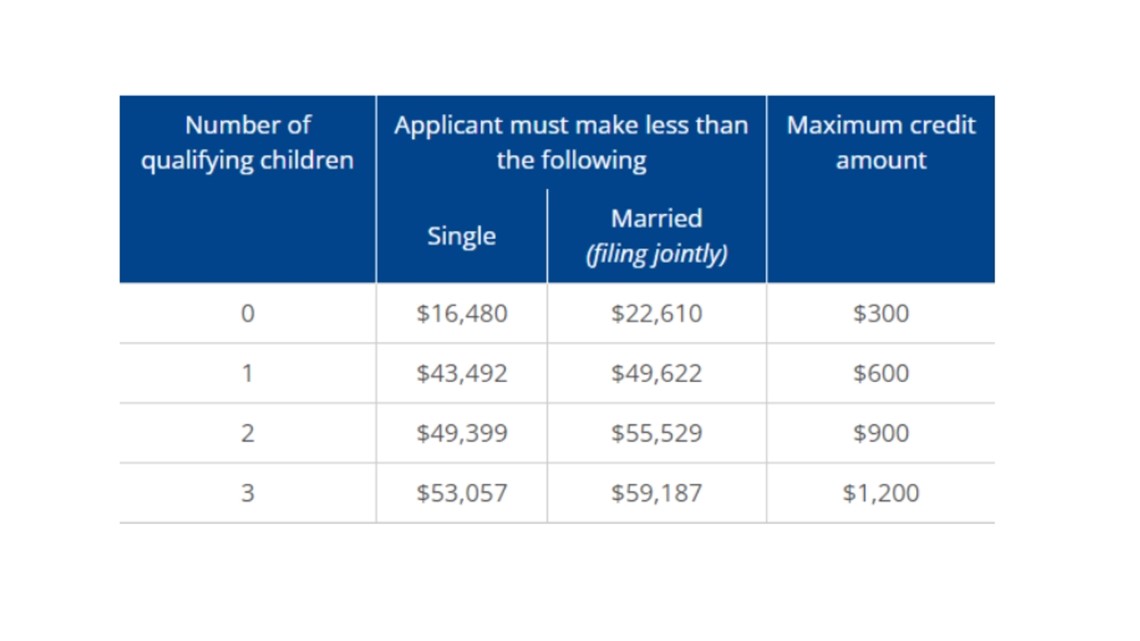

The WFTC is a use tax credit that low-income residents may be eligible for. The credit ranges from $50 to $1,200 depending on various factors of eligibility such as number of qualifying children and income. Other requirements include that an individual meets the eligibility for the federal Earned Income Tax Credit or that they are filing with an Individual Taxpayer Identification number.

A single individual with no children making less than $16,480 a year can expect to receive a maximum of $300 in credit. A married couple filing jointly with two children making less than $55,529 would receive at most $900.

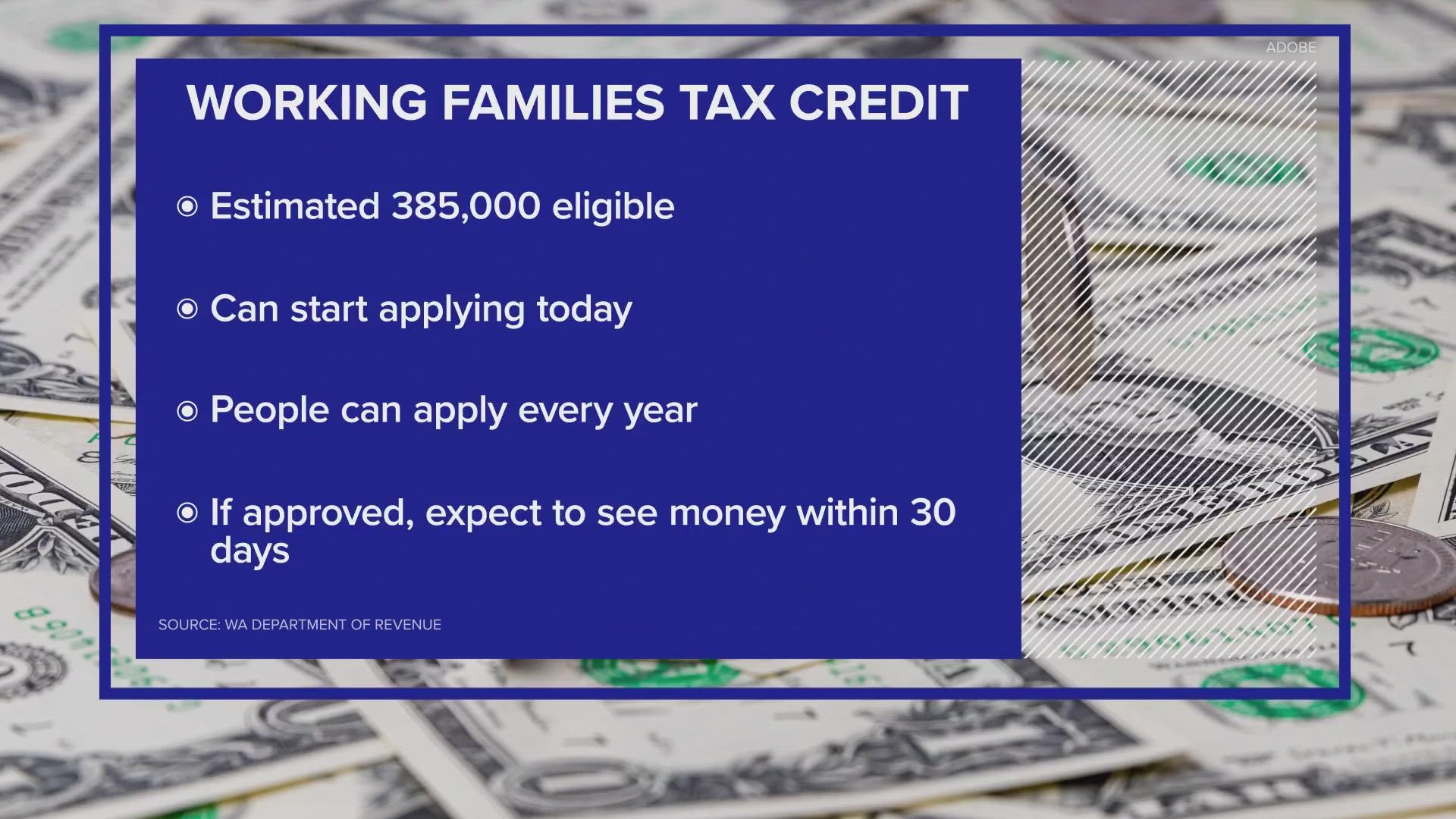

"Based on the estimates that the department conducted back in 2021, we anticipate about 385,000 individuals will be eligible for working families," said Kevin Dixon, the assistant director of WFTC division with the Washington Department of Revenue. "We do have the appropriations from the legislature to fund all of those eligible individuals and families for working families."

The Working Families Tax Credit was approved by Washington state lawmakers during the 2021 legislative session. The state plans for it to be an ongoing program, unlike the federal stimulus checks funded during COVID-19.

“One of the key reasons for the enactment of the program is to combat the regressive tax system we have in Washington,” said Dixon. “The legislature really wanted to combat that regressive tax nature, and give an opportunity for those individuals who need this cash the most, to get a refund of the sales and use taxes that they paid into Washington.”

Applications are available online or in paper which can be submitted by mail to the Washington State Department of Revenue or filled out at a DOR field office. Online applications are available in English or Spanish. Paper applications are available in Arabic, Traditional and Simplified Chinese, Khmer, Korean, Marshallese, Russian, Somali, Tagalog, Ukrainian, and Vietnamese. There are over 40 community organizations that are available across Washington to help assist people fill out their applications including Equity Institute and Washington West African Center.