OLYMPIA, Wash — The start Washington's new mandatory payroll tax to fund a long-term care program would be delayed by 18 months if a pre-filed bill in Olympia passes in the state Legislature.

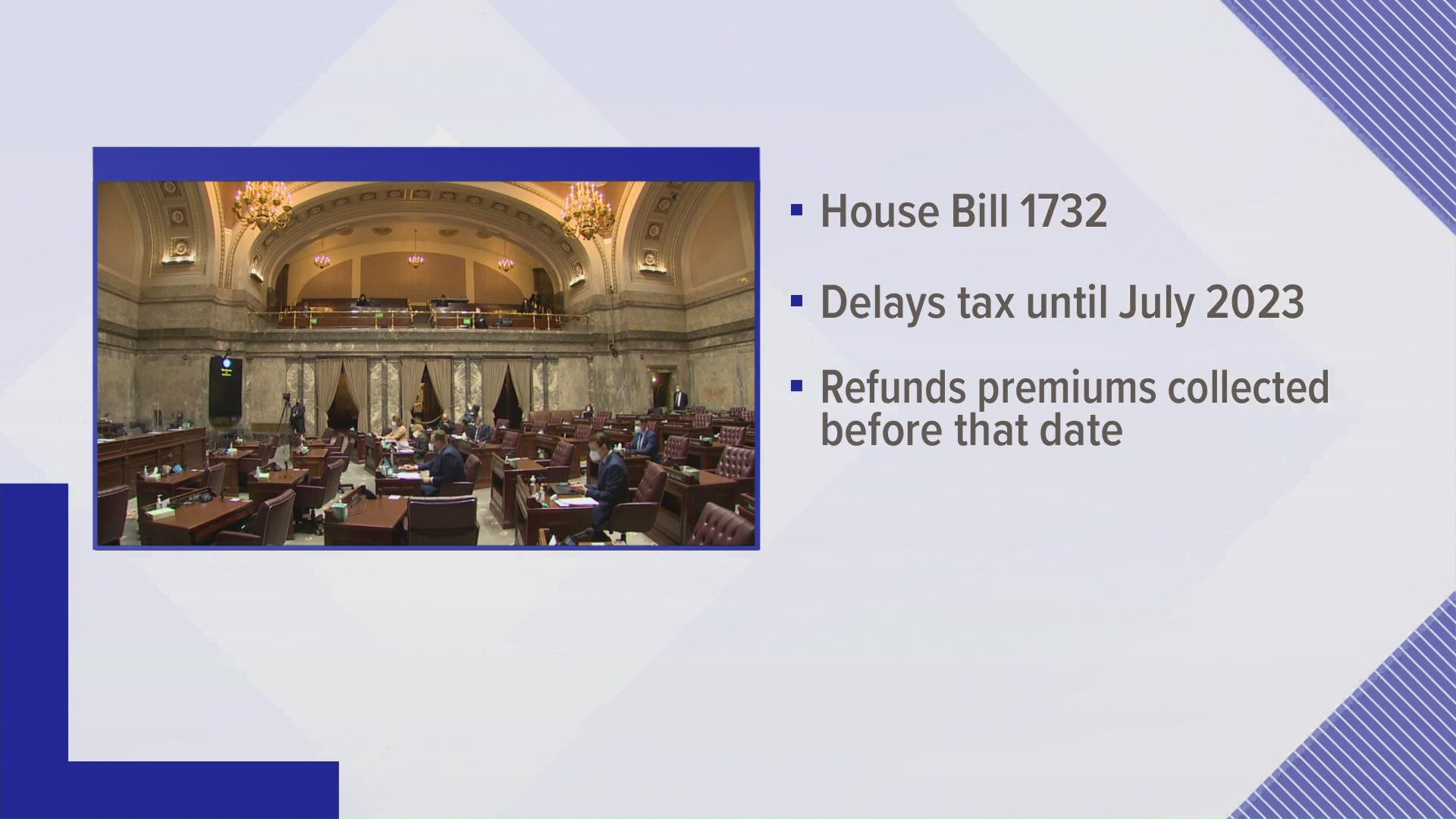

Reps. Pat Sullivan (D-Covington) and Frank Chopp (D-Seattle) filed the bill Jan. 3. If passed, the tax would not be implemented until July 2023.

The reason for the delay, according to the bill's language, is to allow for benefits to be extended to people born before Jan. 1, 1968.

The Employment Security Department will begin collecting premiums for the Washington Cares Fund in April. Collection was originally set to begin in January, but Gov. Jay Inslee delayed its start after ongoing discussions in which "legislators have identified some areas that need adjustments."

Washington passed the first-of-its-kind long-term care tax in 2019. When it starts, Washington workers will pay 0.58% earned into the Washington Cares Fund, which equals 58 cents per $100 earned. Someone who earns $75,000 a year will pay about $435 a year into their account, according to the state Employment Security Department.

The fund ensures taxpayers who have contributed for 10 years receive $36,500 over their lifetime to help pay for long-term care needs, like in-home care, nursing home care, hearing aids, trained support for caregivers, home-delivered meals, memory care, necessary home renovations and many other services, according to the WA Cares Fund website.

Though the Employment Security Department won't collect long-term care premiums from employers until April, some employees will still see that 0.58% be taken out of their paycheck.

According to governor spokesperson Tara Lee, despite Inslee’s order, public and private employers are still required to collect premiums. Private companies that don’t collect the funds won’t be penalized, but as an employer, the state will follow the law until the underlying law is changed. The state will hold collected funds in reserve pending any lawmaker action.

A separate bill, filed by Reps. Dave Paul (D-Oak Harbor) and Nicole Macri (D-Seattle) would allow people to voluntarily exempt themselves from paying into the tax. That includes veterans with a service-connected disability of 70% or higher, spouses or partners of active duty members, people who live outside of Washington state while working in the state and people working in the U.S. under a temporary, nonimmigrant work visa.