SEATTLE — Pot shops, including many in western Washington, have been the targets of a wave of violent and sometimes deadly robberies in recent months.

The robberies, largely blamed on the fact that these businesses have to conduct transactions through cash, have inspired a national call to reform federal banking rules, which make it difficult for these businesses to take virtual payments because cannabis is still a federally controlled substance.

However, the Washington State Department of Financial Institutions (DFI) and the state’s Liquor and Cannabis Board (LCB) are working to tell businesses and consumers about some cashless options that are currently available.

On Tuesday, the DFI issued a message saying that the LCB, DFI, elected leaders, law enforcement and state partners are in discussions on how pot shops can reduce the amount of cash at their locations.

One of the ways the LCB has already tried to address the issue while the nation waits for banking reforms was to implement a state administrative code in 2019 that clarifies how pot shops can use payment service providers.

However, the DFI said very few cannabis businesses are aware of the rule and took the efforts a step further by developing a list of local and regional financial institutions that do provide these kinds of virtual payment services, as well as other banking options, for cannabis businesses.

For instance, Numerica Credit Union has cannabis accounts available and can help businesses in the industry set up online banking, savings and checking accounts and even certificates of deposit, according to its website.

Institutions like Numerica can provide these businesses with the banking services they need while large banks and credit card companies remain unable to work with the cannabis industry due to federal regulations.

Additionally, retailers and customers can also use certain payment apps like CanPay, which was developed with pot shops in mind. The app allows consumers to pay with debit and is already accepted in at least five retail locations in western Washington as well as a couple in the Spokane area.

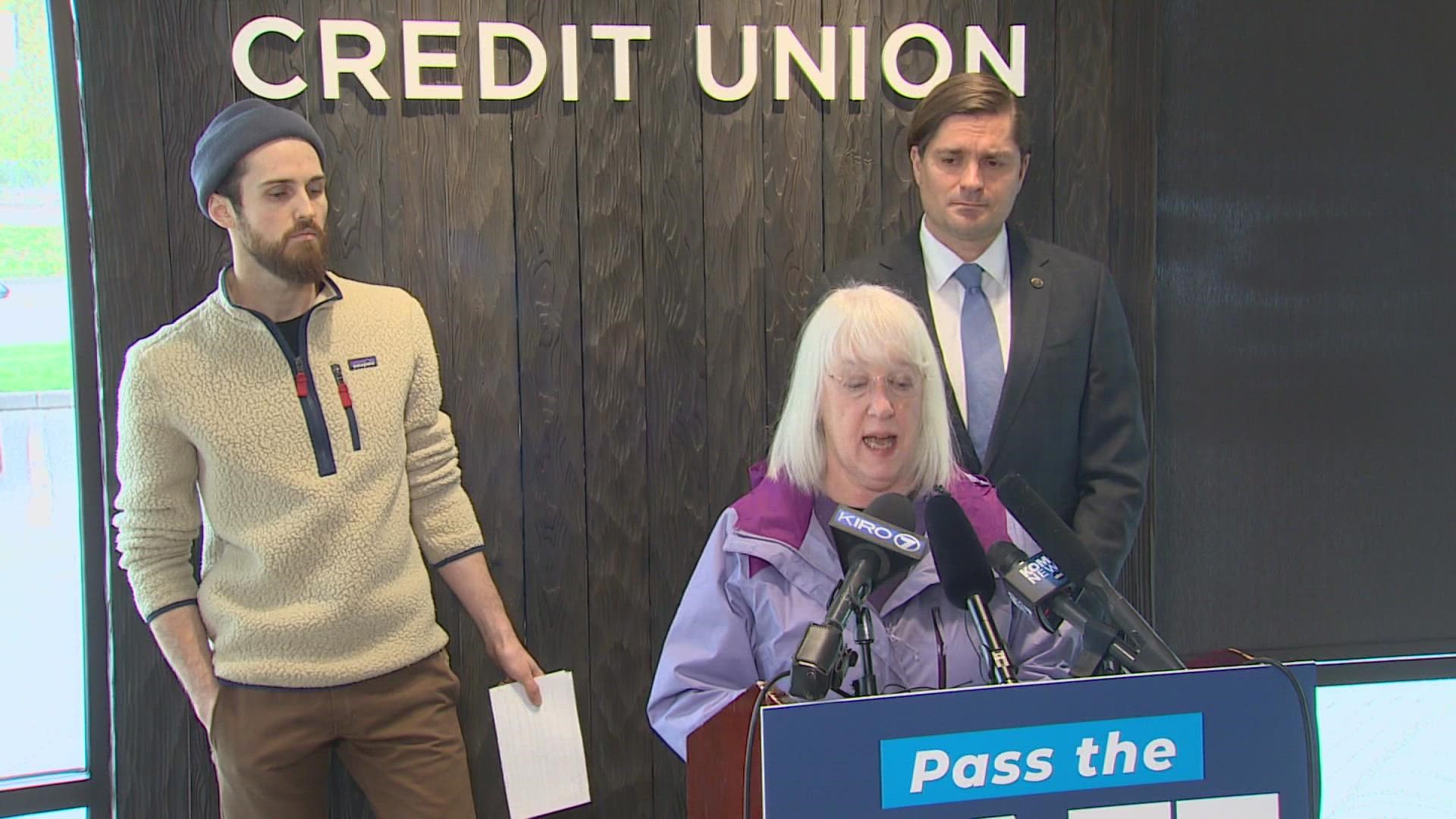

“It makes absolutely no sense that legal cannabis businesses are being forced to operate entirely in cash," Washington Sen. Patty Murray said at a press event on Thursday, the annual 4/20 marijuana holiday.

One industry tracker shows that there have already been at least 80 robberies at cannabis retailers this year, almost all of which have occurred in western Washington.

The SAFE Banking Act, which would reform the federal banking laws and recently passed the House for the sixth time, is heading to the Senate for a possible vote.

The Associated Press contributed to this report.